BP plc BPintends to purchase a lithium ion-based battery technology developed by StoreDot for $20 million. The move is in sync with the company’s target to offer ultra-fast charging battery, which will cater to the increasing demand of electric vehicles (EVs) worldwide.

StoreDot’s technology facilitates fast charging for the mobile and industrial markets.

As the number of EVs is increasing rapidly, BP is working across the supply chain to support the development of the technologies and infrastructure to sustain the growth. The company believes that ultra-fast charging will be vital in speeding up the acceptance of EVs worldwide.

The acquisition emphasizes BP’s commitment toward a lower carbon future with a goal to lower greenhouse gas emissions in its operations. The deal will enable the development of products and services that will help customers to reduce emissions as well as create new low carbon businesses. BP already has more than70 charge points on its retail sites internationally.

Recently, BP made a few investments to venture into renewable energy. In January 2018, BP invested $5 million in FreeWire Technologies, a manufacturer of mobile EV rapid charging systems. On May 10, BP inked an MOU with China’s NIO Capital to examine prospects in advanced mobility.

Per sources, BP plans to reduce workforce in exploration and production by 3%. This will be a part of the streamlining of global upstream business to make the division more competent and viable.

A BP spokesman stated that the company plans to cut about 540 jobs from the total upstream workforce of 18,000 by the end of 2018. BP has divested assets worth $50 billion over the recent years and intends to develop any potential upstream prospects as well as deliver existing five-year growth strategy.

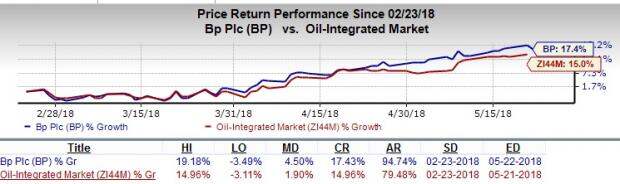

Price Performance

During the past three months, BP’s shares have gained 17.4% compared with the industry’s 15% rise.